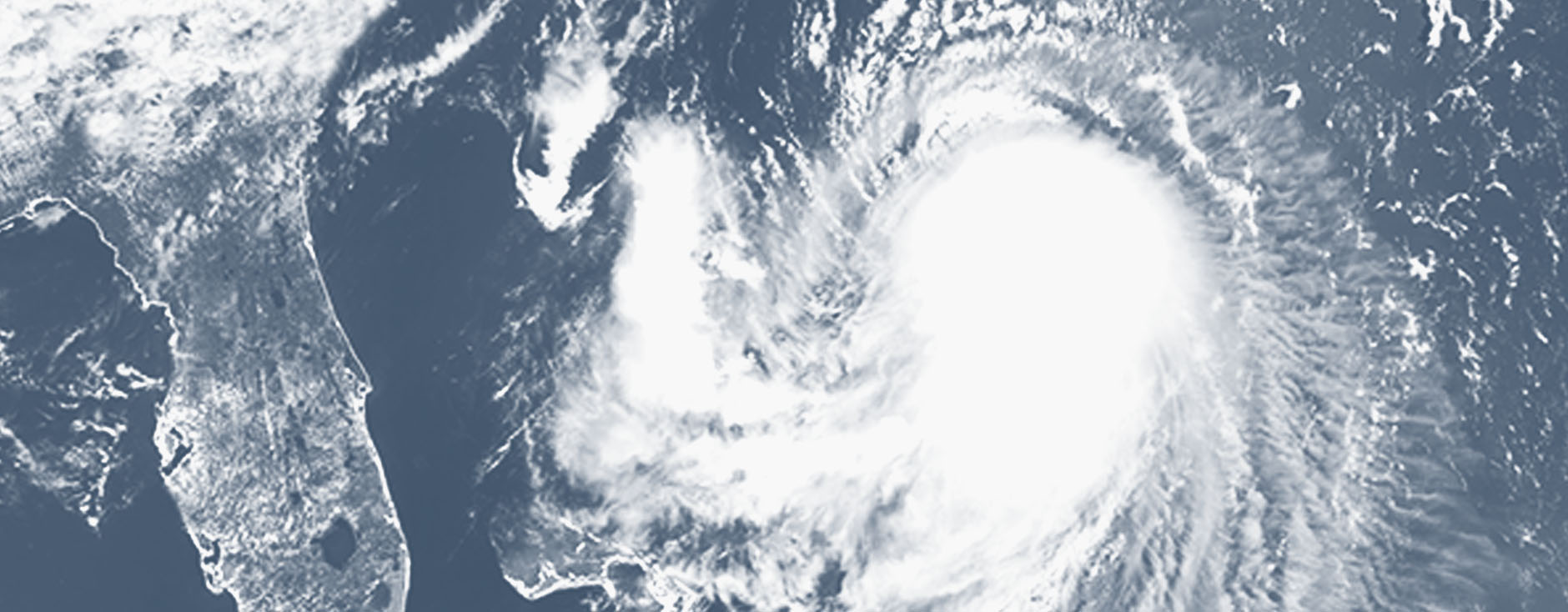

Hurricane Ida Insurance Claims

Schedule a ConsultationHURRICANE IDA INSURANCE CLAIMS

Hurricane Ida has totally devasted Southeast Louisiana with its 150 MPH sustained winds and 185 MPH gust. The homeowners and business insurance are already attempting to reduce payments for their insurance coverage by denying claims for Additional Living Expenses (ALE). new roofs, replacement for walls/sheetrock, electrical and flooring. Also, insurance companies are attempting to reduce the scope of repairs for your hurricane damage and reducing your insurance payments.

Also, Louisiana Law requires insurance companies to pay undisputed hurricane damages after submission of “Proof of Loss” within 30 days and 60 day or could be liable for additional penalties and attorneys. The Proof of Loss form is a statement from the homeowner or businessowner to the insurance company concerning total amount and scope of hurricane damage to their property. The Proof of Loss May include a detailed listin of contents damaged and ALE expenses.

Our law firm has prosecuted over 2000 hurricane and flood insurance claims since Hurricane Katrina. Also, Doug Sunseri was a legal analyst for WDSU for Hurricane Katrina . Mr. Sunseri made weekly appearances on WDSU-TV Channel 6 newscast as a legal analyst on insurance issues. Also, Mr. Sunseri has served as a legal analyst on WWL-TV- Channel 4, WDSU-TV- Channel 6 and WVUE Fox 8. Albert Nicaud is general counsel for the Louisiana State Board of Home Inspectors. Also, you can listen to our radio show “All Things Legal” on Sunday mornings from 8 -10 on WWL 870 AM/105.3 FM/Audacy.com.

Introduction to Hurricane Insurance IDA Claims-1001

Hurricane Ida has caused catastrophic damage to Southeast Louisiana with losses estimated in the billions of dollars. The great people of Louisiana face many challenges in the aftermath of Hurricane Ida, including power outages, lack of running water, accessibility problems, unavailability of gas and supply-chain disruptions. Taking a few proactive steps will help maximize the payouts for your insurance policy.

It is anticipated the legal issues arising from Hurricane Ida insurance claims will be very complex and vigorously contested by insurance companies. Also, Hurricane IDA has devastated businesses. To assist with the claim process, the following is a basic outline of some key issues to facilitate maximum recovery from your insurance policy.

Obtain and Evaluate Policy

Initially, it is crucial to obtain, review, and evaluate the specific terms and conditions of your insurance policy for potential primary and secondary coverages. Understanding the insurance company’s rights and obligations based comprehensive review of the insurance policy is vital to maximizing your recovery. If the policies have been lost or destroyed, request a copy from your insurance agent.

Place Insurers on Notice

Notifying your insurance company as soon as possible is an important step to preserving your insurance recovery. Also, the insurance agent should be notified of the loss.

Document the Loss

Properly documenting the loss or damage to property is critical. This includes not only property damage, but also any property rendered unusable following Hurricane Ida. Before undertaking any restoration activities, document the damages with photos and/or video from your cell phone with an imbedded date and time stamp. Establish separate accounts to track losses, including any extra expenses, professional fees, mitigation, clean-up costs, and other expenses associated with the storm and the recovery period. Keep a log or diary of all actions taken by you. Save all repair receipts and other records of additional expenses made necessary by hurricane-related damage. Remember that insurance company adjustors work for the insurance company and not you.

Follow the Policy to Preserve the Claim

After initial notice of loss, you must submit to the insurance company a Proof of Loss” to catalogue and document the damages. In addition to the proof of loss, you have a duty to preserve and protect the property from further losses, including any and all necessary mitigation activities. Such expenses are often covered under the homeowner’s policy. If your insured residence or business has water damage to the ceilings and/or walls, portable generators, fans and their component should be reimbursed since said apparatus was utilized to mitigate damages.

Assess all Possible Coverages

Your insurance policy has secondary and additional coverages. Please note, homeowners’ policies and most business policies exclude flood damages and is covered by a separate FEMA flood policy. In addition to providing coverage for physical damage to an insured’s property, many commercial policies provide coverage for losses due to the interruption of the normal business activities, such as lost revenue or profits. Business interruption and related time-element losses may quickly exceed physical damage claims and may well constitute the majority of a business’s losses. Also, damage to your business may trigger extended coverages, such as service interruption coverage. Likewise, curfews, prohibitions against entry and physical obstructions to roads may trigger “Civil Authority” or loss of ingress/egress coverage. Some specific policies may possibly provide coverage for disruption of power and other utilities. Finally, there may be coverage even if the insured’s property was not physically impacted by the storm, as disruptions to certain suppliers and/or customers may result in covered “contingent business interruption” losses. Again, you must read the specific terms and conditions to identify primarily and secondary coverages for your business insurance policy.

For More Resources About Hurricane Ida And How We Can Help You, Check Out These Blog Posts:

- Lowballing by Insurance Companies for Your Hurricane Ida Claim

- Hurricane Ida – Document, Document and Document

- HURRICANE IDA INSURANCE CLAIMS – FALLEN TREES

- Additional Living Expenses (ALE)

- Insurance Coverage for Additional Living Expenses (ALE) for Evacuation

- Business Interruption-Civil Authority or Physical Loss

- How to Create a Contents List for Insurance Claims

- Reasons Your Insurance Company Should Replace Your Roof

- How to Respond to Hurricane Ida Insurance Company’s Low-Ball Estimates

- Insurance Company’s Legal Duty to Timely Pay Hurricane Ida Claim-Attorney’s Fees and Penalties

Practice Areas

Client Reviews

Going through a very NASTY divorce Michelle Sunseri and her staff were super caring, helpful, sincere, trustworthy,and honest. They really went the extra mile. I highly recommend.

Case Results

$25 Million +

Recovered in BP Claims

$40 Million

Recovered In Hurricane

& Flood Claims

contact us today

Get Answers Today

Which attorney would you like to contact?